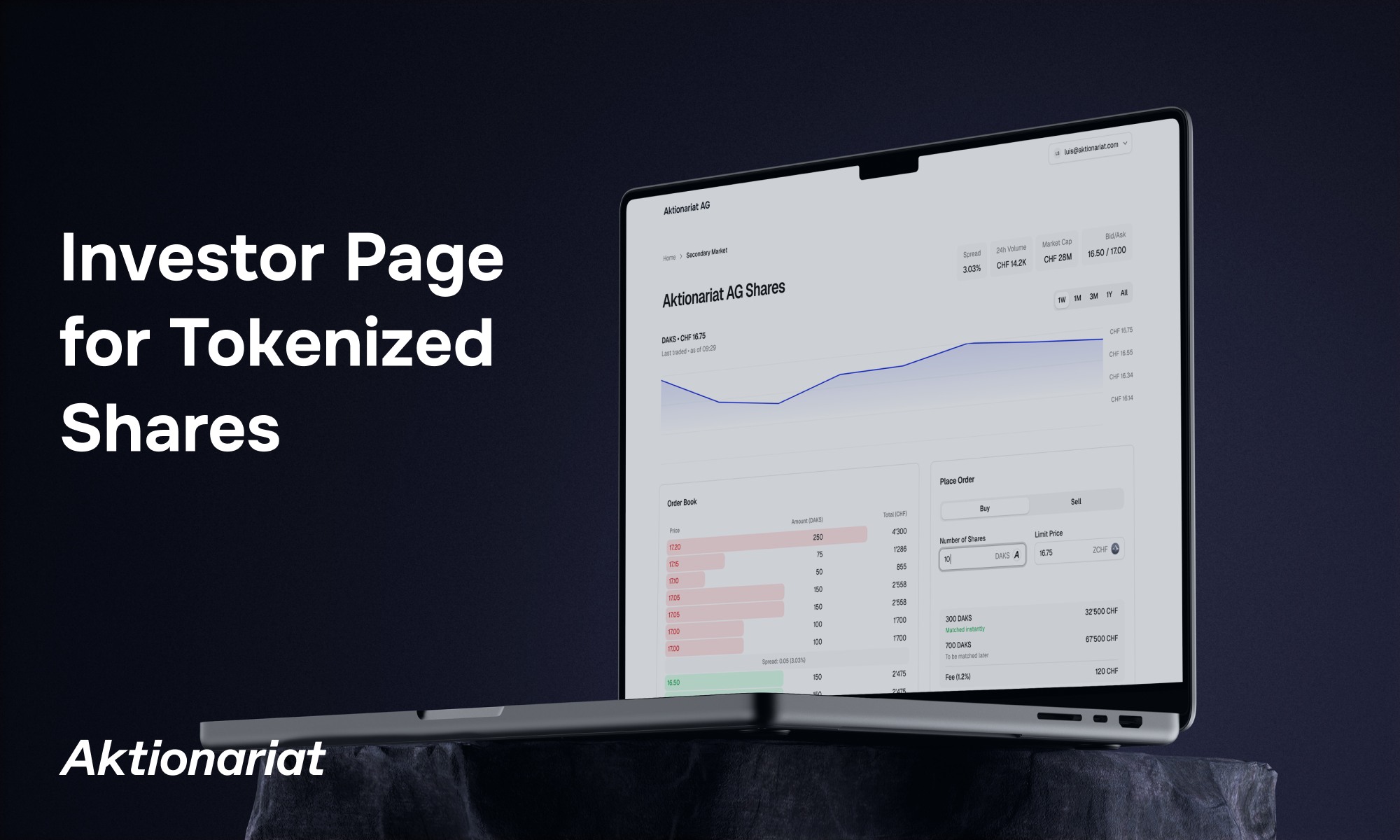

Aktionariat AG announces the launch of Investor Page, a new product that transforms how Swiss companies manage shareholders and how investors buy, hold, and trade tokenized shares. Built on Aktionariat’s existing tokenization infrastructure used by more than 80 companies and powered by blockchain technology, the Investor Page enables issuers to offer a fully digital shareholder interface that supports direct investment and seamless secondary trading.

The Investor Page replaces fragmented shareholder administration with an integrated system designed for tokenized equity. Companies can manage ownership digitally while investors gain direct access to their holdings, transactions, and trading opportunities through a single, user-friendly interface.

Private equity has historically relied on manual processes, intermediaries, and disconnected systems. By leveraging tokenized shares under Swiss law and the Swiss DLT Act, Investor Page enables companies to automate shareholder management and create new liquidity channels through built-in digital investment and trading functionality. The solution is available to Swiss companies seeking a modern infrastructure for digital equity.

“Tokenization fundamentally changes how companies manage shareholders and how investors participate in private markets,” says Murat Ögat, Co-Founder & CEO of Aktionariat AG. “Investor Page combines digital shareholder management, direct investment, and secondary trading in one environment. It gives companies a scalable way to manage tokenized equity and offers investors a more efficient and accessible investment experience.”

Rethinking the Shareholder Experience for Tokenized Equity

Investor Page acts as the central hub for shareholders. Instead of relying on spreadsheets, email coordination, and offline processes, companies can operate a digital shareholder registry directly connected to blockchain-based shares. Investors can participate in capital raises, manage their holdings, and access secondary trading through the same environment.

Key capabilities of Investor Page include:

- - Digital shareholder management powered by tokenized equity

- - Direct investment through on-platform share offerings

- - Integrated support for secondary trading between shareholders

- - Automated ownership records synchronized with blockchain infrastructure

A modern, user-friendly interface for issuers and investors

By standardizing digital shareholder management, Aktionariat enables companies to scale their investor base, streamline operations, and unlock new forms of liquidity for private equity.

Building the Infrastructure for the Next Generation of Equity

“As private markets move toward digital infrastructure, companies need tools designed for tokenized ownership,” adds Ögat. “The Investor Page we make available for our issuers is a key building block for the next generation of private equity.”

Investor Page is available to Swiss companies using Aktionariat’s tokenization platform. Aktionariat itself uses the Investor Page to enable direct investment and secondary trading at: https://shares.aktionariat.com

Aktionariat invites all Swiss companies to explore how tokenized equity can modernize their shareholder management and unlock new opportunities for their investors.

Learn more about the Investor Page here.