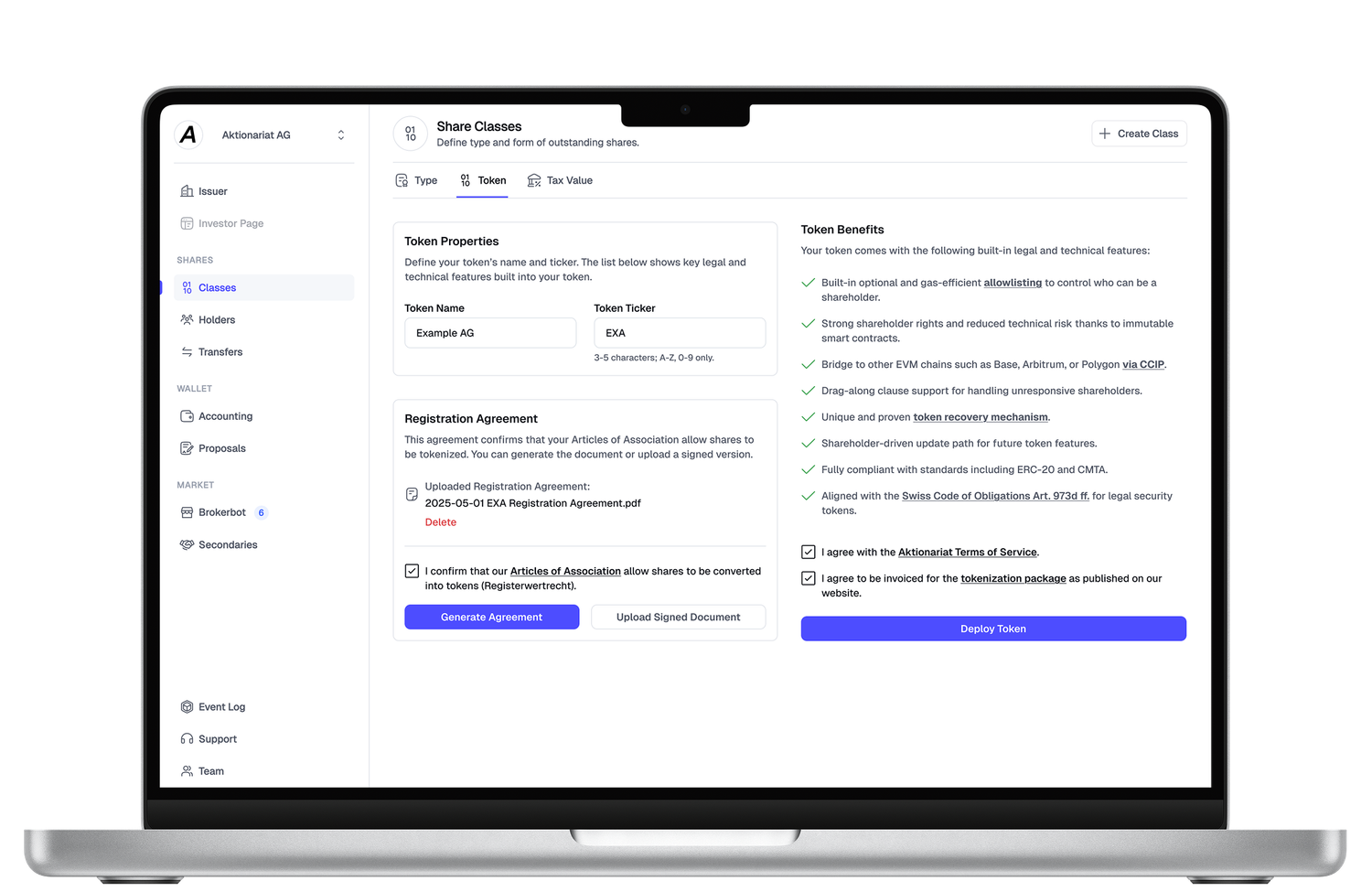

Tokenization of Private Company Shares

The foundation for issuing, managing, and trading company shares as tokenized equity.

Tokenization as a Modern Equity Solution

With tokenization, company shares are represented as digital assets. This makes issuance simpler, ownership transfers easier, and compliance transparent throughout the share lifecycle. Tokenization creates the basis on which all other shareholder, investor, and market processes can operate digitally and compliantly.

The Challenge We Solve

Traditional equity issuance is often slow, paper-heavy, and difficult to scale. Tracking ownership, transfers, and compliance manually creates friction and limits future options. Tokenization replaces these constraints with a standardized digital foundation.

Benefits of Tokenizing Shares

Faster and Automated Share Issuance

Smart contract–based issuance reduces administrative overhead, shortens issuance timelines, and minimizes errors. Tokenization allows companies to issue, allocate, and update shares in a fraction of the time required by traditional processes.

Built-in Compliance and Transparency

Tokenization embeds compliance rules directly into the share lifecycle. Ownership records, approvals, and transfers are traceable and auditable at all times, providing transparency for management, regulators, and investors while reducing legal and operational risk.

Scalable and Cost-Efficient Structure

Once shares are tokenized, the same infrastructure supports future growth. Companies can scale issuance, manage larger shareholder bases, and enable additional solutions such as market access and trading - without increasing administrative complexity or operational costs.

Legal Framework for Tokenized Shares

Tokenization at Aktionariat is built on a solid legal foundation. Our framework is based on Swiss DLT Law, which enables the issuance of ledger-based securities in a fully compliant way. Together with our legal partner LEXR, a leading expert in DLT regulation, we ensure that every tokenization setup meets regulatory and governance requirements.

Articles of Association

To enable tokenization, company Articles of Association are updated to legally recognize tokenized shares and digital ownership rights.

Investor Agreements

Clear contractual structures define investor rights and obligations, including: Registration Agreement, Token Holder Agreement, and Shareholder Agreement.

Tokenization in the Real World

Tokenization is increasingly used by companies and institutions worldwide to modernize equity structures, improve transparency, and reduce administrative complexity. Clear regulatory frameworks, especially in Switzerland and the EU, are accelerating adoption across private markets.

FAQ About Tokenization

Yes. You can choose to tokenize the existing share class, or create a new class specifically for tokenization. Any combination of tokenized and traditional share classes is supported.

Yes. You can manage conversions between traditional and tokenized shares at any time, allowing you to start small and scale as needed.

Start Building Your Digital Share Infrastructure

Turn equity into digital assets. From first setup to a fully compliant, scalable equity ecosystem, we’ve got you covered.