Shareholder Management

Automate your cap table and keep shareholder records accurate, compliant, and always up to date.

All Tokenized Companies

Join the companies that have already digitized their equity and governance.

Trusted by Leading Companies

"Startup shares are, by default, extremely hard to sell. In practice, they are illiquid and static. Having a solution where you can buy, sell, and trade tokenized shares easily changes everything. It removes friction completely. This is not a small improvement. It is a fundamental shift in how startup financing works."

"We chose Aktionariat as our partner back in 2022. The Issuer Portal, including the share register and its extensive customization options, was a key factor in our decision. A range of features are highly useful, including transaction signing and analytical reporting. We are very satisfied with Aktionariat."

"It is a new digital way of trading shares. It is much easier and speedier than trading in the traditional way. In general, everything is documented automatically and you have everything in one place. Furthermore, you can reach out to potential investors you normally wouldn’t meet. It is also a very nice way to distribute shares to employees. The value of one share is much concrete, since it is shown in the Aktionariat Portfolio App."

One Ecosystem. Everything You Need for Tokenized Equity.

Aktionariat brings all the tools for tokenized equity into a single ecosystem from shareholder management and issuance to trading and compliance.

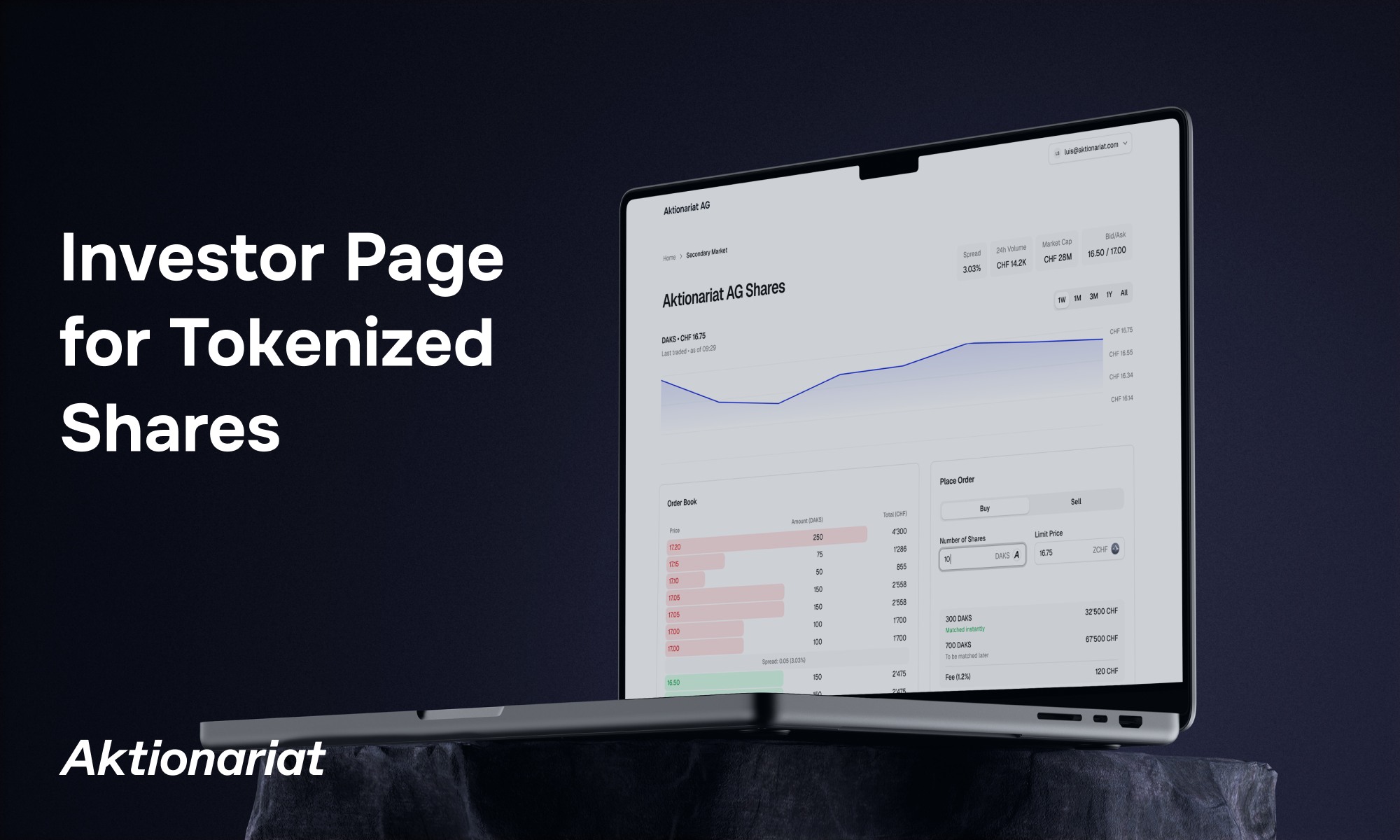

A branded interface for investors to buy and trade your equity.

Your company, your branding

Host your Investor Relations page on your domain and present your brand consistently to every investor.

Direct access to new investors

Let potential shareholders invest directly from your website, strengthening relationships without intermediaries.

Transparent, compliant trading

Every transaction is recorded on-chain, ensuring clear price discovery and regulatory transparency.

Easy integration into your website

Embed the Investor Relations interface with a single script or iframe - no heavy development needed.

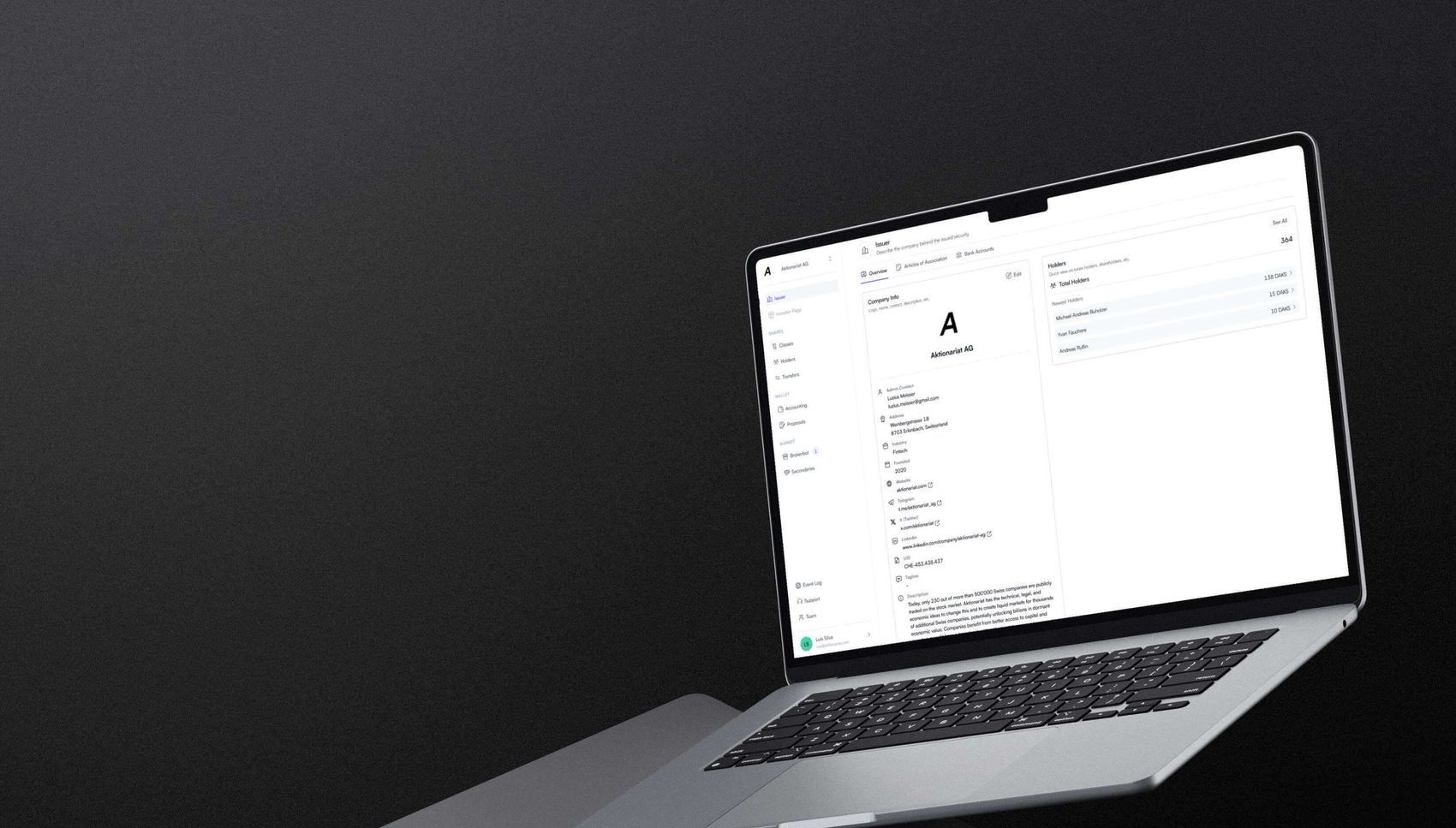

Manage your company and shareholders in one secure dashboard.

Real-time cap & shareholder registry

Powered by blockchain, ownership changes and shareholder records update automatically in real time with every trade or transfer.

Built-in Swiss compliance controls

Stay aligned with Swiss company law—automated record-keeping and validation keep your share ledger compliant by default.

Simple share issuance & transfers

Issue new shares or transfer existing ones on-chain, without paperwork or manual reconciliation.

Transparent financial reporting

Get a live view of your company’s equity, valuation, and investment history in one organized dashboard.

Instant portfolio updates

Shareholders see real-time performance and valuation changes across all their tokenized holdings.

Secure digital wallet built-in

Each user manages their shares safely with self-custody - no need for external wallets or third parties.

Buy & sell shares seamlessly

Execute trades directly from the app with automatic order matching and transparent pricing.

Works across supported networks

Compatible with Ethereum, Polygon, Optimism, and Base chains for maximum flexibility and accessibility.

Blog Posts & News See the Latest from Aktionariat

Interested in more?

Start today for free or let us show you how it works.