IPOs were yesterday—state of the art companies go live with a Security Token Offering: How Security Token Offerings create new financing opportunities for Swiss Startups and SMEs

If you are a small or medium-sized company and want to grow but lack the money for a classic IPO, you should definitely read on. In this post, we'll go over the benefits of a Security Token Offering and why we think it's the best option for raising capital for SMEs.

Key insights in a nutshell:

- IPOs have been almost impossible for SMEs because a traditional IPO is very expensive.

- New technologies such as blockchain are leading to numerous innovations in finance.

- One of these innovations is the Security Token Offering (STO)

- An STO allows SMEs to raise capital by selling shares in a simple and, most importantly, affordable way

- Since 2021, Switzerland has been leading the way for the tokenized shares with the DLT Act

What is an IPO?

IPO means "Initial Public Offering" and describes the process of listing a company on the stock exchange (or going public). With an IPO, a company is able to sell company shares in the form of stock. In an IPO, this is exactly what happens for the first time for a stock corporation: the issuance of shares.

Why do you do an IPO?

There are various motives why a company goes public. Classically, stock corporations are managed by several shareholders who all own shares in the company. If one of these owners wants to exit the company, they can sell their shares to other investors on the stock exchange. In such a case, one speaks of an "exit".

However, the most common reason for an IPO is to raise additional capital. If a company wants to grow, it needs capital for this purpose, which can be raised by selling shares.

How does an IPO happen?

Before an IPO can take place, a whole series of regulatory requirements must be met. For example, companies must have a minimum equity capital of 2.5 million Swiss francs or a core prospectus in order to be listed on the stock exchange. An essential part of an IPO is also the valuation of the company, for which various processes and parties are required. According to SIX, it usually takes six months for a company to be admitted to the stock exchange.

What are the disadvantages of an IPO?

Because it takes so many processes and players to do an IPO, an IPO is one thing above all: expensive. Schweizeraktien.net puts the costs for the IPO of a Zurich-based mechanical engineering company at 2 million Swiss francs and for a logistics group as high as 56 (!) million Swiss francs.

In the past, therefore, only large corporations could afford such an IPO—small and medium-sized companies were left out. Luckily, all that changed in August 2021, when Switzerland became one of the first countries in the world to lay the legal foundation for the STO - the Security Token Offering - with DLT Act 2.

What is an STO?

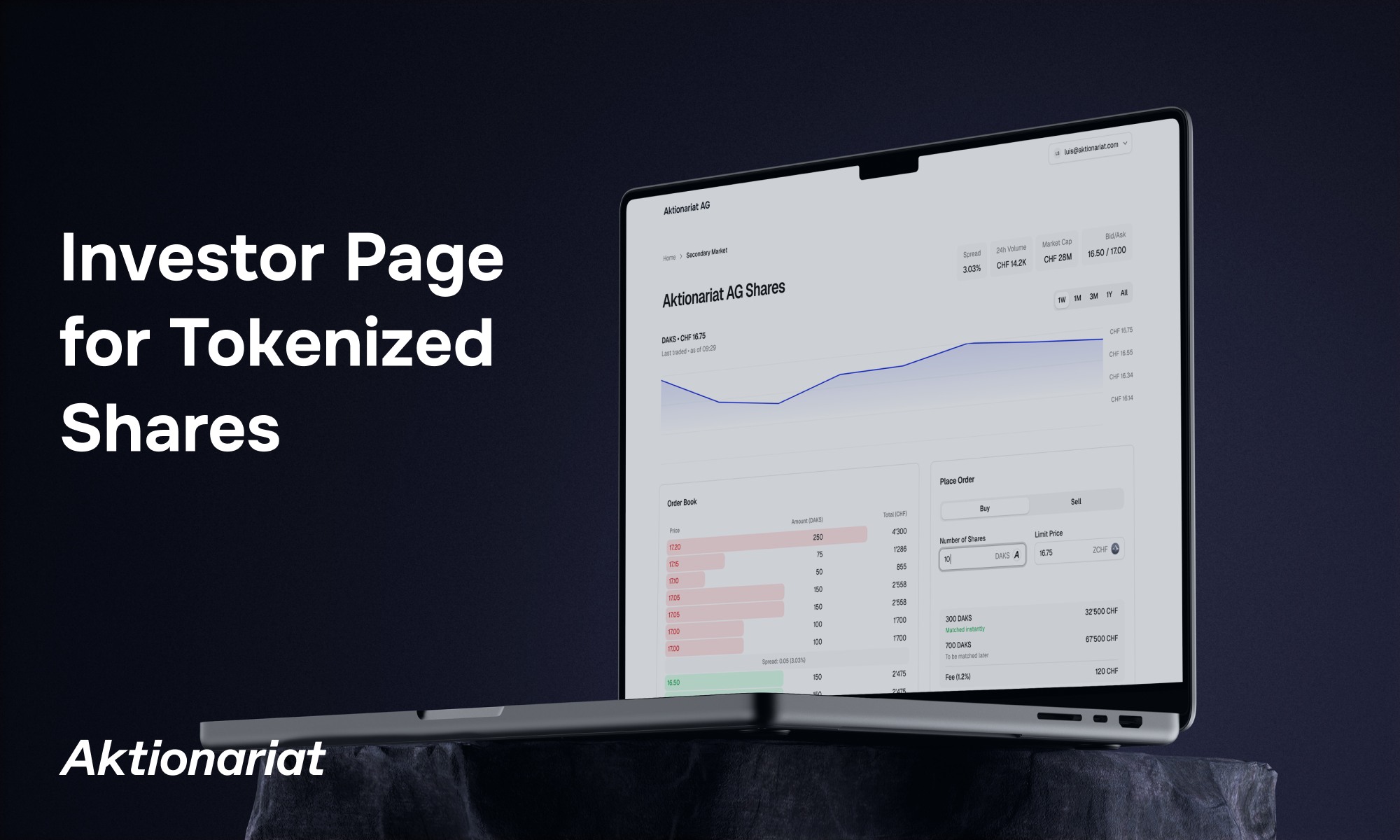

A security token offering, or "the issue of tokenized assets for financing purposes", is a completely digital and simplified version of an IPO. When a company does an STO, it can, for example, set up a page on its own website where all interested parties can buy shares.

What are tokenized shares?

In an STO, however, it is not traditional shares that are sold, but tokenized shares. To help you understand what is meant by this, it is best to start at the very beginning. When stocks were first traded in the early 19th century, it happened in physical form on paper. With the advance of digitalization, trading could eventually be done from the comfort of one's own home using one's own computer. However, this still required a bank as an intermediary between the seller and buyer of the share—direct purchase from the company itself was not possible until now. But that's where things get exciting now, because with innovative technologies—namely distributed ledger technology (DLT)—came the blockchain and with it the tokenized share. This means that nowadays neither the corporation nor the buyers of shares need a third party like the bank. One can therefore certainly speak of a revolution in share trading. We will explain below what advantages this offers you as an entrepreneur or share buyer.

In Switzerland, company shares worth up to CHF 8 million can currently be sold per year. Some SMEs that have taken an innovative step with an STO are, for example:

What are the advantages of an STO for SMEs?

If you also decide to go for an STO, you will enable yourself the following advantages:

- No dependence on banks: you can finance yourself completely independently

- Cheap, easy and fast capital raising compared to a classic IPO

- Send a strong price signal, as the value of the shares can be viewed at any time and is linear to the number sold.

- Highly motivated employees thanks to company participation

- Stronger relationships with customers and other stakeholders thanks to company participation

- Liquidity premium if done with a Brokerbot© (Buyers are willing to pay up to 30% more for a liquid asset)

- If desired: simple, gradual exit of initial investors and founders

How can I sell tokenized shares as an SME?

It is true that today, for an STO and thus for raising capital for a small and medium-sized enterprise, third parties in the form of banks etc. are no longer necessary...However, unless you have a deep knowledge of IT and finance, you need a company that provides you with the necessary tools to give you access to this automated market.

Aktionariat is one of the leading service providers in Switzerland for such Security Token Offerings. We have already assisted 29 companies with their STO.

Is an STO secure?

You've probably heard of the blockchain. But did you understand it the first time around? Blockchain offers a whole range of benefits and even opens up new business areas, however, for some, the underlying technology is so complicated to understand that they unfortunately don't look into it any further.

However, the initial question "Is an STO secure?" can be answered quite simply: Yes, an STO as well as tokenized shares are actually very safe!

Why? Because there is not only one central entity—such as a bank—but a decentralized network of independent nodes instead, that takes over the administration of a share trade.

This means that if one party fails to act as expected (deliberately or by accident), there are still many others who can execute a trade correctly. Thus, the STO clearly emerges as the winner in terms of security. (However, no technological innovation like the tokenized share will save you as an investor from bad investment decisions either 😉).

What are the benefits for buyers?

In 2022, the Competence Center for Banking & Finance at the University of Applied Sciences of Eastern Switzerland, together with a project team of business partners, founded a Swiss industry association called "Digital Assets". According to its website, one of the association's goals is: "To make the capital procurement and management processes for companies and especially SMEs simpler, more efficient, more transparent, and more secure".

Prospective buyers therefore profit from the following advantages:

- Easy share purchase (with just a few clicks).

- Affordable shares (since individuals often don't have the same financial resources as, say, a pension fund)

- Share purchase possible at any time (and not only during the week from 09:00 - 16:30)

- Liquidity* (if you need money quickly, you can simply sell your assets)

- Private equity for everyone (and not just the super rich)

*However, a company can also disable this feature when issuing tokenized shares. This means that with certain companies you cannot sell the assets at any time. As a buyer, you can see whether a company has activated this function or not on the Investor Relations page of the respective company.

Conclusion

Growing as a small or medium-sized business has become not only affordable but also very easy thanks to the development of blockchain and STO. Switzerland, as the world's leading financial center, offers small and medium-sized companies an ideal and secure basis for selling tokenized shares.

The numerous advantages of an STO make it difficult for Swiss SMEs to find a well argued explanation why you have not yet seized this opportunity for your own growth...

We at Aktionariat AG are sure that in the coming months and years we will read about many more SMEs taking the step into a simpler, successful and digital future and if you want to be part of it, we are always here to help you out.